Introduction

Last month, I talked with a founder in San Francisco who started an AI app for school

students. When I suggested hiring engineers from our community, he said he preferred only

remote workers from the USA.

His choice was based on Section 174, which he learned about from articles warning against

international hires, which lead to higher taxes. This surprised me because the concern would

be time zones.

At first, it concerned me because I didn't think Section 174 would be a big deal. But I

started to see many people talking about it online and how it negatively impacts

startups.

One famous article everyone was referring to was Gergely Orsoz's recent article. This

article left founders puzzled about scaling teams in the USA and hesitant to establish R&D

outside the country. It is even causing layoffs because startups are unable to manage

cashflows.

Here’s a tweet about section 174 made by Gergely Orosz:

Section 174 is still in place, still devastating to smaller US software companies and startups, and I'll now be writing about it. Odd how there is so little talk about all this, given the impact.

— Gergely Orosz (@GergelyOrosz) January 3, 2024

If you're impacted by this and want to take a look at the draft, drop me a DM. https://t.co/EWbDVmQWB8

Section 174 introduces a critical shift is that R&D expenses are no longer immediately

deducted. Instead, they are spread out over a specified period (5 years for the U.S. and 15

years for international operations).

In the context of startups, this means that software engineers' R&D expenses related to

software creation are subject to amortization under this section.

Here’s a tweet related to it by Ankur Nagpal

Typically, when you hire employees, what you pay them in salaries is deductible upfront

— Ankur Nagpal (hiring engineer + marketer in NYC) (@ankurnagpal) January 8, 2024

People are the biggest cost you’ll have

Section 174 changes this for software engineers & now requires you to amortize their salary over 5 years

And you can only deduct 10% Year 1!

As the founder of Hyno, a company that builds remote teams for startups, I realized that

Section 174 could impact my business model. I started researching extensively to understand

its implications. After reviewing numerous articles on IRS tax codes, I am summarizing my

research, especially for startups.

First, let's define and apply Section 174 according to the regulations.

What is Section 174?

Section 174 of the Internal Revenue Code (IRC) deals with the tax treatment of research and

experimental (R&E) expenditures. It allows businesses to deduct the expenses incurred in

product development or improvement, processes, or formulas as they occur over time.

This deduction applies to tangible and intangible assets developed through research and

experimentation. By providing tax incentives to businesses, this provision encourages

innovation and investment in research and development activities.

What is section 174 for tech startups?

The concern arose from the proposed tax changes. These changes require businesses to amortize certain (R&D) expenses over five years instead of allowing immediate expensing under Section 174. Additionally, the company should amortize it over 15 years if the R&D is conducted internationally.

Breaking Down Software Development and R&D Spending Based on IRS Definitions

To begin, let's define computer software and then explore the tasks categorized under software development and associated R&D expenses.

Definition of Computer Software:

Computer software includes any program or routine designed to make a computer perform functions. It encompasses various types of software and media, including system software, application software, and upgrades.

Software Development Activities

Now, let's categorize activities into those that are considered part of software development and those that are not:

| Activities Considered as Software Development | Activities Not Included as Software Development |

|---|---|

| Planning: Outlining objectives, scope, and resources for software projects. | Software developed for internal use: Software developed for internal use: Development of software intended for internal use within the organization, rather than for sale or distribution to external users. |

| Designing: Creating the blueprint or structure of software, including its architecture and user interface. | Training: Providing instruction or education on how to use software effectively. |

| Building Models: Constructing prototypes or mock-ups to visualize and refine software functionality. | Maintenance: Keeping software operational and up-to-date, including bug fixes and updates. |

| Code: Developing program instructions and converting them into machine-readable code. | Data Conversion: Converting data from one format to another, such as migrating data to a new system or software. |

| Testing: Assessing software performance, functionality, and reliability through various tests. | Installation Activities: Activities related to installing software on users' systems or within an organization's infrastructure. |

| Production-ready: Generating final versions or master copies of software for distribution or deployment. | Marketing: Promotional activities aimed at increasing awareness and sales of software products. |

| Testing and modification activities: Generating final versions or master copies of software for distribution or deployment. | Maintenance without enhancements: Promotional activities aimed at increasing awareness and sales of software products. |

| Distribution: Distributing software to customers or users, such as packaging and delivery. | Customer Support Activities: Providing assistance and resolving issues for users of the software. |

R&D Costs As SRE(specified research or experimental expenditures)

Now that we've covered the tasks, let's explore the expenses related to them that are considered part of R&D.

| R&D Costs considered as SRE | R&D Costs, not considered as SRE |

|---|---|

| Labor Costs

Compensation for employees and contractors involved in SRE (Specified Research or Experimental) activities. |

Indirect Support Costs Costs incurred by general and administrative service departments that indirectly support SRE activities. |

| Materials and Supplies Costs Costs for materials, supplies, tools, and equipment used directly in SRE activities. | Interest on Debt for SRE Activities Interest payments on debt used to finance SRE activities. |

| Cost Recovery Allowances Depreciation, amortization, or depletion allowances for property used in SRE activities. | Other Specific Costs Costs for activities unrelated to SRE, such as inputting content into a website or registering a domain name. |

| Patent Costs Costs related to obtaining patents, including attorney fees and other expenses associated with patent filings. |

Certain Amortization Costs Amortization of specific expenditures not eligible as SRE expenditures, such as amortization of general business expenses or marketing costs. |

The core of the Section 174 problem for startups

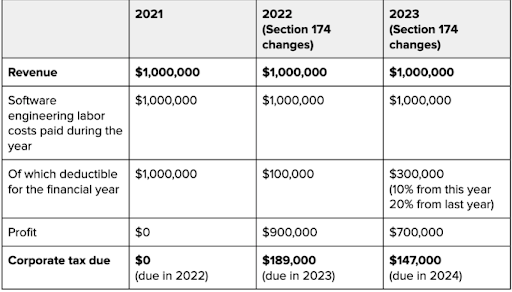

Let's look at some numbers to see how things are affected. We'll start with the scenario Gergey described.

Scenario: Take an imaginary bootstrapped software business called “Acme Corp.” This company generates $1,000,000 of revenue per year running a SaaS service. It employs five engineers and pays each $200,000. That is $1,000,000 paid in labor costs. For simplicity, we omit other costs like servers and hosting, even though those costs can also fall under the new R&D rules and must be amortized. So, how much taxable profit does this company make?

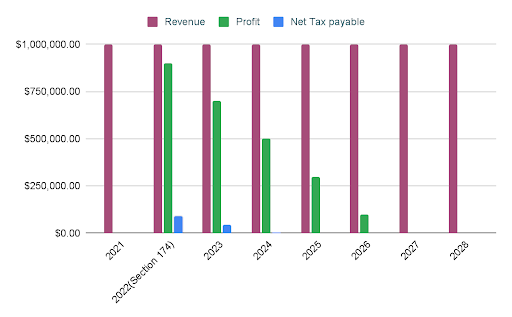

Gergey's scenario is uncommon for most startups. However, in this case, it could hit the startup hard. Let's expand on this and see how it affects the startup over the next five years in the diagram below. Also, considering there is a tax credit as per section 41, around 10% of R&D spending.

Startups may initially face significant cash flow challenges due to amortization,

particularly in their early stages. However, as we analyze the data over five years, we

notice a trend where the impact gradually diminishes.

For example, by 2027 and 2028, the effect becomes negligible. Although this burden is severe

on startups in the first two years, it's essential to recognize that this burden tends to

decrease over time.

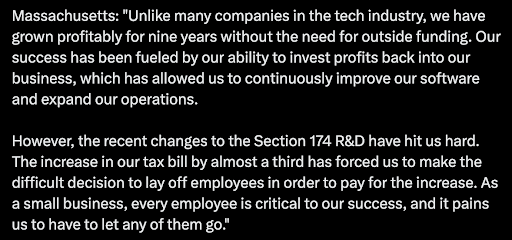

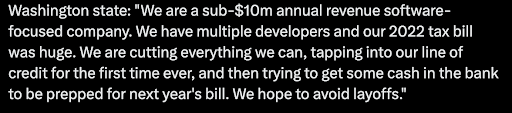

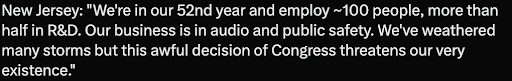

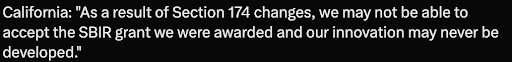

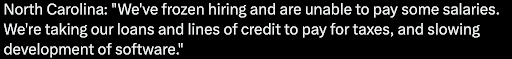

For startups where R&D expenses represent a significant portion of revenue, the impact can

be very high, which may lead to layoffs as it seriously affects their cashflows. Not all

startups face threats similar to those in section 174. I am sharing some anonymous stories that are shared on Twitter where it got seriously affected

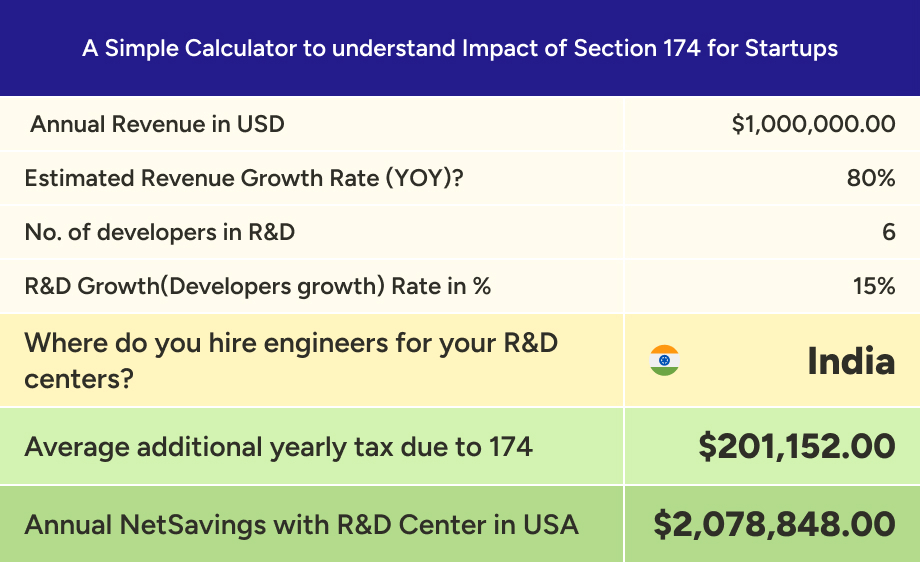

Seeing how much this situation can affect startups can be scary. But it's important to

remember that not all startups will be impacted similarly. Every startup is different, and

many factors can change how much of an impact it has. I've created a simple tool to help

founders understand how this situation might affect them.

Instead of analyzing results for just one year, let's extend it to five years also in the

case of R&D conducted outside the USA, to 15 years to provide a comprehensive understanding

of the situation.

Let's go ahead with a real scenario.

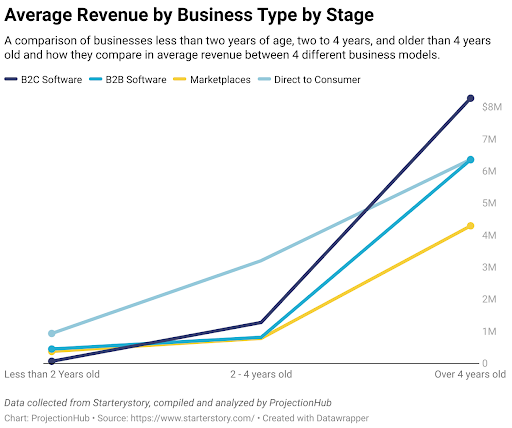

Understanding a Real Scenario of a Founder

To understand how Section 174 impacts startups that are genuinely concerned about it, I've

categorized them based on their revenues. Using data from real startups from startupstory,

I've created various segments.

Here's a graph illustrating the time it takes for startups in different segments to achieve

million-dollar revenues.

Let's delve into a realistic 5-year scenario. Building a B2C app or SaaS platform entails

significant upfront costs. It often necessitates fundraising since turning a profit from day

one is usually unfeasible. They enable solo entrepreneurs to develop and sell SaaS solutions

globally while reaching out to customers in multiple countries.

Let's get into numbers with some real examples. Calvin, who was recently selected by YC,

aims to create a SaaS platform for invoicing. He assembles a team of 5 developers with an

average salary of $200000 each, estimating six months to a year to complete the MVP. After

launching and testing with the enterprise clients, let's assume the annual billing per

client averages around $20,000 per year.

Assuming he just started with five clients and, in the best-case scenario, has a 100 percent

growth rate in sales each, and assuming he increases his R&D spend every year by 20 percent

as he needs more people to build more features, we can analyze the potential trajectory of

Calvin’s startup.

Here's a screenshot of Calvin's startup, illustrating the impact of Section 174.

Calvin's total tax burden, calculated over 15 years, amounts to $3,6 Million. This

information is based on a screenshot from our custom calculator created by the Hyno team.

This translates to an additional tax payment of USD 240,240 per year. Please check out our

estimator here for specific details for each year and how to use

it.

Let us take a look at some more real scenarios.

More Real Scenarios

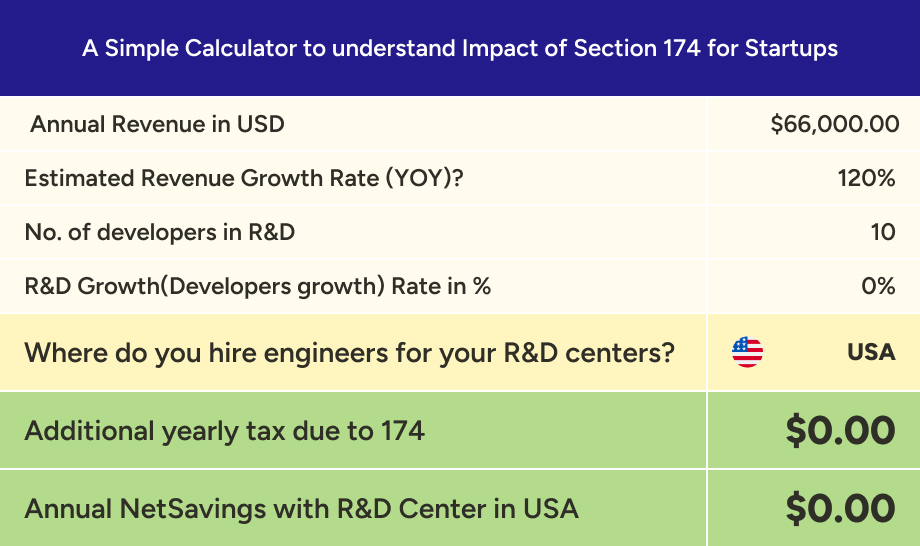

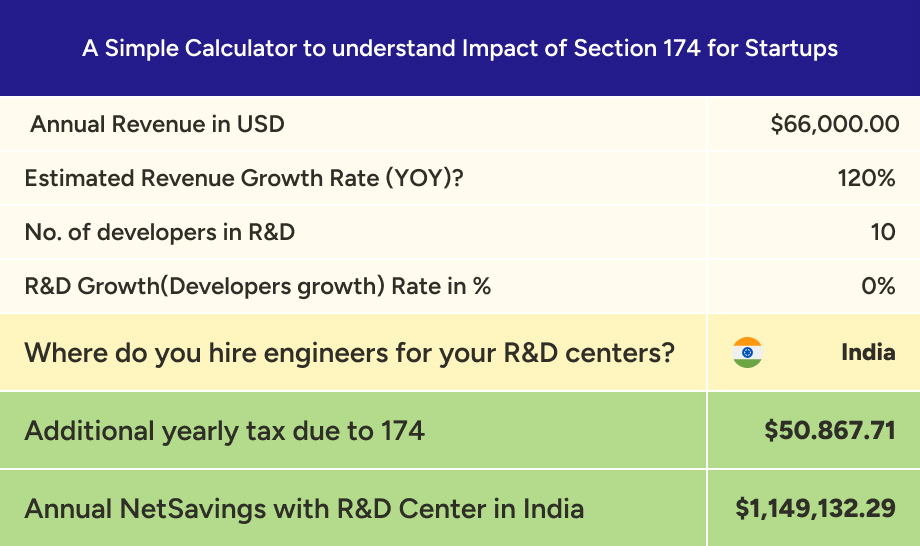

Case 1: B2C company Company A, with 66 K revenue growing at 120 percent year over year, started with 10 developer teams and maintained the same team size for the next 15 years.

There's no impact here because the company started making profits after five years, and by then, the amortization period had ended. So, there won't be any effects to worry about.

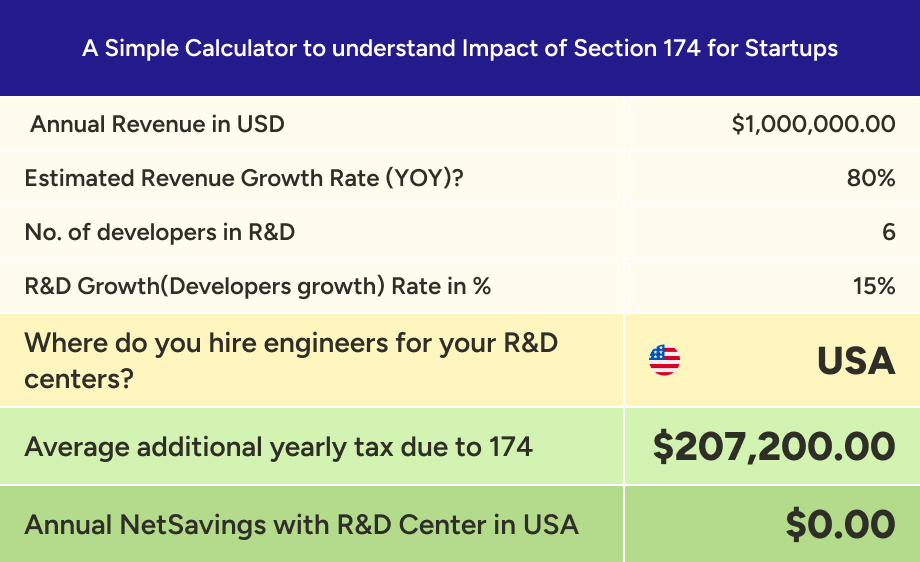

Case 2: D2C startup with 1M USD revenue growing at 80 percent YOY revenue

started with six developer teams with 15% growth YOY on R&D

These are approximate figures for the cash flow impacts mentioned here. Actual numbers may

vary depending on expenses.

Section 174 significantly impacts if your revenue is high and your R&D spending increases

quickly. However, if you're at the early pre-revenue stage, it will have little effect.

What Happens If You Choose an R&D Center Abroad?

Another concern is that if the amortization period extends to 15 years, having an R&D center

abroad would have a more significant impact. Let's compare the three scenarios mentioned

above with India, where the average salary of a skilled developer is $80,000 compared to

$200,000 in the USA.

Let's take the same example where the same firms have built their R&D centers outside the

USA.

Case 1: B2C company Company A, with 66 K revenue growing at 120 percent year over year, started with 10 developer teams and maintained the same team size for the next 15 years.

There's a difference here, as you'll notice an extra tax bill of around $50,000 annually. But let's pay attention to the significant savings from choosing India for your center instead of the USA. In total, it's like saving almost $1.2 million every year and paying an extra $50,000 but still saving 1.15 Million even choosing a center outside the USA and with an amortization period of over 15 years.

Case 2: D2C startup with 1M USD revenue growing at 80 percent YOY revenue started with six developer team with 15% growth YOY on R&D

Compared to the USA scenario, we observe that you're paying nearly similar tax bills in both cases, yet by selecting a center in India, you've saved $2 million annually.

Conclusion

Thank you for taking the time to go through everything. Through my research, I've found that

the impact of section 174 varies significantly for each startup. It affects cash flows, but

how much varies between startups.

As a founder, I urge you to calculate the impact based on your numbers instead of getting

unnecessarily scared. While some scenarios might be challenging, I hope you find the courage

to navigate them. For founders in the early stages of revenue, it's crucial to understand

the impact before making any decisions and not blindly following others.

Even with a 15-year amortization period, some scenarios have shown people benefitting. I've

created the estimator so you can input your numbers and truly grasp the impact on your

startup.

Try our Section 174, Impact Estimator

If it still needs to provide clarity, try out our Section 174 Impact Estimator yourself with

real figures from your company books. Remember that it gives rough estimates and might not

be exact. Also, it only considers revenue after subtracting one-time expenses. Give it a try

to see how it works!

Try

Our Section 174, Impact Estimator